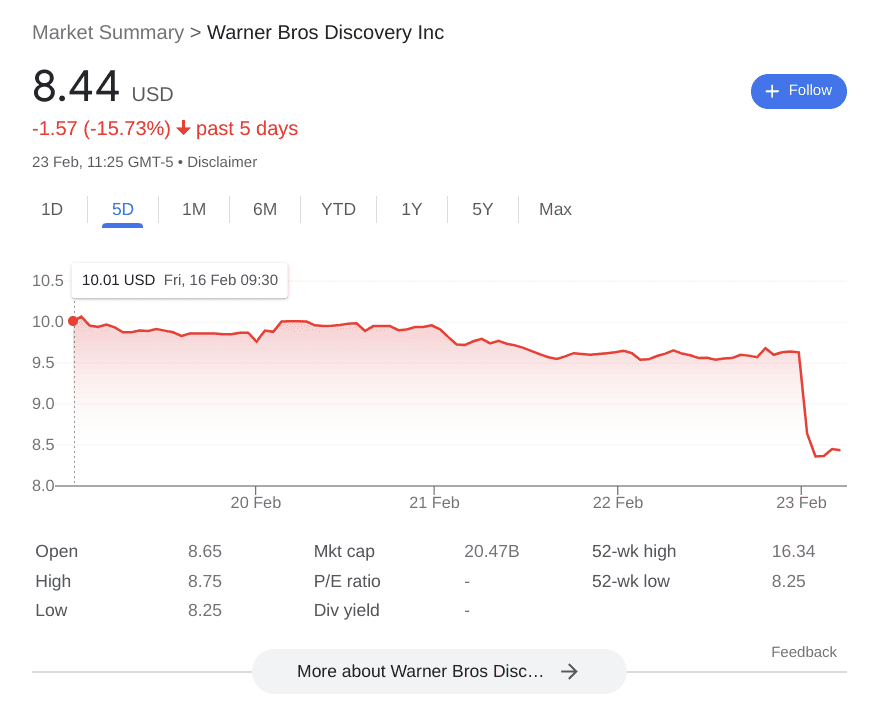

Warner Bros. Stock Just Jumped Off A Cliff

Warner Bros. Discovery share prices took a huge hit today, as values dropped another 11 percent. The company’s fourth-quarter numbers showed that the streamer had weak linear advertising and a struggling production studio, but the most compelling issue for investors was that the report didn’t show Warner Bros. Discovery’s plans for the upcoming year.

Warner Bros Stock Plummeting

Typically, a full-year forecast is released alongside the fourth-quarter reports, but this year it was omitted. With weak numbers and no plan for the future, share investors are nervous and unsure about where their money might go.

Today marked the lowest devaluation of Warner Bros. Discovery stock since the two companies merged in 2022. Starting at $24.47 a share in April of 2022, the streamer’s stock dropped to the lowest number the company has seen since the merge, just $8.36, this morning. At the close of the day today, shares had only moved back up to just $8.57.

Broken Warner Bros Promises

All of these financial hits combined with the company’s broken promises to bring stocks back up to $16.00 while all the signs point to a financial crisis doesn’t bode well for the future of Warner Bros. Discovery.

When billions of dollars have been lost in just two years, what do you do to recover?

Strikes Played A Part

In addition, advertising fell 14 percent, due to a lackluster interest in the streamer from viewers and advertisers alike.

The Warner Bros. Discovery studio took a hit when the SAG-AFTRA strikes took place last year, making the filming studio have a terrible quarter.

Then there was the hopeful news of a Disney/Fox sports bundle that didn’t result in any help to raise numbers either.

Streamer Stocks Down

The valuation of Warner Bros. Discovery when it was created just two years ago sat around $60 billion. Just 24 months later, the company is valued at around $21 billion, marking a devastatingly significant loss.

However, the numbers arguably don’t look good for any of the main streaming platforms, except for Netflix (of course).

Disney shares are down 50 percent from 2021. Paramount is down roughly 90 percent from 2021, and Comcast lost around $825 million for Peacock last quarter.

Except Netflix

Meanwhile, Warner Bros. Discovery and the rest of the streamers lie in the shadow of the golden child of streaming, Netflix, as they shoveled in an estimated $1.7 billion last quarter. Netflix clearly has all of the other streamers wondering what’s so special about their business model, and if they’re not wondering, they should be.

Still Hope For Warner Bros.?

Warner Bros. Discovery chief financial officer Gunnar Wiedenfels made a statement saying that the company “will not be focused so much on individual quarters’ or years’ profitability” but that the company would set its goals towards fueling growth.

It’s worth mentioning that in the midst of all of the bad numbers, Warner Bros. Discovery did see a gain in their overall numbers for the year.

It will be interesting to see how this all pans out in the next few months, but something is definitely awry in the streaming world.